Canada Parent Visa 2026 marks an exciting milestone for families worldwide who dream of reuniting under one roof. The Canadian government has unveiled powerful new insurance and eligibility rules under the Super Visa program, making long-term family stays more flexible — yet financially secure.

In this comprehensive guide, you’ll discover how the 2026 Super Visa updates affect parents and grandparents of Canadian citizens and permanent residents, including new insurance coverage standards, processing changes, and expert tips to maximize approval success.

What Is the Canada Parent and Grandparent Super Visa?

The Super Visa is a long-term, multiple-entry visa that allows parents and grandparents of Canadian citizens or permanent residents to stay in Canada for up to five years per visit, with the possibility of extension.

Unlike a regular visitor visa (valid for six months), the Super Visa is specifically designed for family reunification, enabling loved ones to spend meaningful time together without frequent reapplications.

Key Highlights:

- Valid up to 10 years.

- 5-year stay per visit (updated in 2022).

- Renewable and extendable under new 2026 policies.

- Requires private medical insurance coverage.

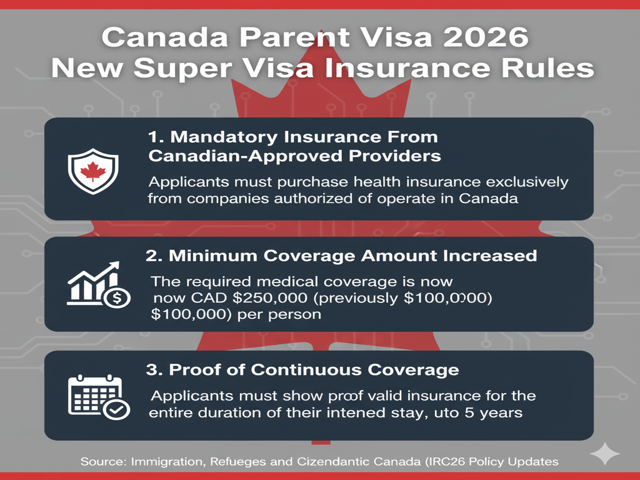

Canada Parent Visa 2026 New Super Visa Insurance Rules

One of the most powerful updates in 2026 centers on insurance and financial proof requirements.

1. Mandatory Insurance From Canadian-Approved Providers

As of January 2026, all Super Visa applicants must purchase medical insurance from Canada-based companies approved by Immigration, Refugees, and Citizenship Canada (IRCC).

This ensures:

- Direct claim payments within Canada.

- Simplified verification for IRCC officers.

- Higher reliability for healthcare coverage during stays.

2. Minimum Coverage Amount Increased

The minimum coverage requirement has been raised from $100,000 to $150,000 CAD for emergency medical, hospitalization, and repatriation.

This change reflects Canada’s growing healthcare costs and ensures applicants are adequately protected.

3. Proof of Continuous Coverage

Applicants now need to provide proof of continuous coverage for the entire intended stay period. Temporary or partial policies are no longer accepted.

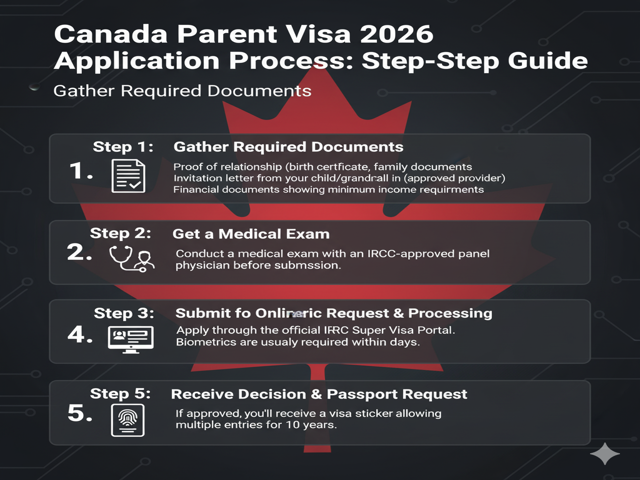

Canada Parent Visa 2026 Application Process: Step-by-Step Guide

Here’s a simplified, updated step-by-step process to apply for the Canada Super Visa 2026:

- Gather Required Documents:

- Proof of relationship (birth certificate, family documents)

- Invitation letter from your child/grandchild in Canada

- Proof of medical insurance (approved provider)

- Financial documents showing minimum income requirements

- Get a Medical Exam:

Conduct a medical exam with an IRCC-approved panel physician before submission. - Submit Online via IRCC Portal:

Apply through the official IRCC Super Visa Portal. - Wait for Biometric Request & Processing:

Biometrics are usually required within 30 days. - Receive Decision & Passport Request:

If approved, you’ll receive a visa sticker allowing multiple entries for 10 years.

Financial Requirements (Canada Parent Visa 2026 Update)

The Low Income Cut-Off (LICO) requirement is adjusted annually. For 2026, the sponsor (child/grandchild) must meet the following minimum income thresholds based on family size:

| Family Size | Minimum Income (CAD) |

|---|

| 2 persons | $46,000 |

| 3 persons | $56,000 |

| 4 persons | $68,000 |

| 5 persons | $77,000 |

| 6+ persons | $87,000+ |

Tip: Sponsors can combine income from spouses to meet the threshold.

Approved Insurance Companies (Canada Parent Visa 2026 List)

Under the new rules, IRCC recognizes select Canadian insurance providers only. Here are some approved names (subject to updates):

- Manulife Financial

- Sun Life Assurance

- Blue Cross Canada

- Desjardins Financial

- GMS Travel Insurance

Key Benefits of the Super Visa (2026 Edition)

✅ Long-term multiple entry (10 years)

✅ Stay up to 5 years without renewal

✅ Simplified health coverage verification

✅ Stronger family reunification benefits

✅ Easier extension and renewal process

Common Reasons for Refusal

Even under the new system, many Super Visa applications fail due to:

- Weak financial proof from sponsor

- Inadequate insurance coverage

- Missing relationship documents

- Failure to pass medical exams

- Unclear intent to return

Related Post: Canada Express Entry 2025: Exciting Category-Based Selection Trends

FAQs – Canada Parent Visa 2026

1. How long does the Super Visa take to process in 2026?

Average processing time is 6 to 8 weeks, depending on the visa office.

2. Can parents work on a Super Visa?

No, Super Visa holders cannot work in Canada.

3. Is insurance refundable if the visa is denied?

Most Canadian insurance providers offer partial refunds, minus admin fees.

4. Can I switch from a Super Visa to PR?

Yes, if you apply under the Parent and Grandparent Sponsorship Program (PGP) later.

Agent Advise – Canada Parent Visa 2026

The Canada Parent Visa 2026 reforms represent a powerful shift toward safer, clearer, and family-friendly immigration policies. By strengthening insurance and income rules, Canada ensures parents and grandparents can stay longer with peace of mind — while protecting the healthcare system.

If you’re planning to apply in 2026, start early by securing approved insurance coverage, preparing income proofs, and following IRCC’s verified process to maximize your chances of approval.

Pingback: Canada Express Entry 2025-26: Powerful CRS Score Trends