The Rise of the Digital Entrepreneur

As global economies shift toward digital innovation, countries are adapting to attract remote talent and online entrepreneurs. The Digital Services Visa 2026 represents a major step forward — a revolutionary visa program designed for online business creators, digital marketers, and freelancers who run their operations virtually.

This new category bridges the gap between digital nomad visas and business visas, offering flexibility, tax benefits, and long-term residency options for those contributing to digital economies.

What Is the Digital Services Visa 2026?

The Digital Services Visa (DSV) is a new type of residence and work permit that enables individuals who earn primarily through online platforms or digital businesses to live and operate in a foreign country legally.

It targets entrepreneurs, YouTubers, eCommerce sellers, marketers, and freelance professionals who provide global services online — regardless of their clients’ locations.

In short:

The DSV is your passport to running your online business from anywhere in the world — legally, securely, and with full access to digital infrastructure.

Key Features of the Digital Services Visa 2026

- Global Eligibility – Open to citizens of 100+ countries.

- Low Income Requirement – Minimum earnings as low as $2,000/month.

- Fast-Track Application – Fully digital application process with AI verification.

- Flexible Residency Period – Stay from 1 to 5 years depending on host country.

- Tax Incentives – Reduced or exempted income tax for qualified online services.

- Family Inclusion – Spouses and dependents can apply for dependent visas.

Eligibility Criteria for Digital Services Visa 2026

To qualify for the Digital Services Visa 2026, applicants typically need:

- Proof of steady online income (PayPal, Stripe, Upwork, etc.)

- Valid passport with at least 6 months’ validity

- Health insurance with global coverage

- Clean criminal record certificate

- Portfolio or proof of digital business ownership

Some nations also require:

- Evidence of tax compliance

- Remote work contract or online service agreement

Countries Offering the Digital Services Visa 2026

Several forward-thinking nations have already launched or are preparing to launch the DSV program:

- Estonia – Leader in e-residency and digital governance

- Portugal – Expanding its nomad and entrepreneur visa categories

- UAE – Targeting digital talent through Dubai’s Virtual Work Program

- Thailand – Integrating online business workers into Smart Visa programs

- Barbados & Costa Rica – Offering tropical hubs for remote creators

Each country sets its own requirements, tax rates, and visa durations, but all share the goal of attracting digital economic contributors.

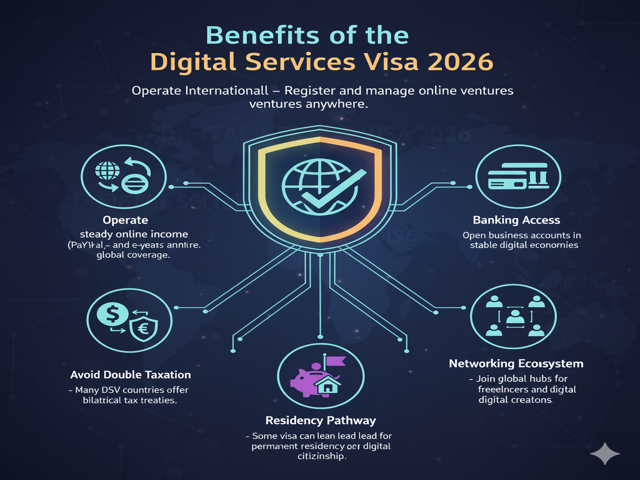

Benefits of the Digital Services Visa 2026

- Operate Internationally – Register and manage online ventures anywhere.

- Avoid Double Taxation – Many DSV countries offer bilateral tax treaties.

- Residency Pathway – Some visas can lead to permanent residency or citizenship.

- Networking Ecosystem – Join global hubs for freelancers and digital creators.

- Banking Access – Open business accounts in stable digital economies.

How to Apply for the Digital Services Visa 2026

- Step 1: Choose Your Country – Review DSV-eligible nations and their income rules.

- Step 2: Prepare Documents – Income proof, tax compliance, and digital business license.

- Step 3: Submit Online – Through the country’s immigration or e-visa portal.

- Step 4: Wait for Approval – Average processing time: 2–6 weeks.

- Step 5: Relocate & Register – Once approved, register for tax and residence benefits.

Visa Costs and Processing Time

| Country | Average Fee (USD) | Processing Time | Validity |

|---|

| Estonia | $130 | 2–4 weeks | 1 year |

| Portugal | $150 | 4–6 weeks | 2 years |

| UAE | $250 | 2–3 weeks | 1 year |

| Thailand | $180 | 3–5 weeks | 2 years |

Tax Implications for Digital Entrepreneurs

While most countries offer favorable tax conditions for DSV holders, it’s crucial to:

- Check double taxation treaties between your home and host countries.

- Keep digital income records transparent.

- Use registered business structures (LLC, sole proprietor) for compliance.

Source: UAE Digital Nomad Visa

Expert Tip: Combine DSV with e-Residency

To maximize your global freedom, pair your Digital Services Visa with e-Residency programs such as Estonia’s — letting you open a global business online with EU credibility and access.

Related Post: Digital Nomad Visas 2025-2026: 30+ Countries Compared

FAQs

Q1: Who qualifies for the Digital Services Visa 2026?

Freelancers, eCommerce sellers, digital marketers, and online educators with steady income.

Q2: Can I bring my family?

Yes, most DSV programs allow dependent visas for spouses and children.

Q3: What income proof is required?

Typically $2,000–$3,000 monthly from online platforms or clients.

Q4: Do I need to pay local taxes?

Depends on the host country’s treaty with your home country — always check with a tax consultant.

Agent Advise: The Future of Work Is Borderless

The Digital Services Visa 2026 marks a revolutionary era for global creators. With governments recognizing online entrepreneurs as legitimate contributors to national economies, the world is moving toward a borderless, opportunity-rich digital future.

Whether you’re a freelancer, coach, or business owner — the DSV gives you the freedom to build, live, and grow globally.