Canada Super Visa 2025 marks a major upgrade in how family reunification is handled. This long-term visa allows parents and grandparents of Canadian citizens and permanent residents to visit for up to five years per entry, with an option to extend for another two years — all without needing frequent renewals.

But for 2025, there’s a powerful change: new insurance requirements aimed at ensuring all visiting parents and grandparents have adequate health and emergency coverage during their stay.

In this article, we’ll cover everything you need to know about the new Super Visa insurance rules, updated eligibility, trusted insurance providers, and how to apply smoothly.

What Is the Canada Super Visa 2025?

The Super Visa is a multiple-entry visa designed for the parents and grandparents of Canadian citizens or permanent residents. It offers an extended stay of up to five consecutive years per visit, much longer than a standard visitor visa.

Unlike the regular visitor visa, which allows six months per entry, the Super Visa provides long-term flexibility — a great option for families living abroad who wish to spend extended time with loved ones in Canada.

Quick Fact: The Super Visa was first launched in 2011. Since then, over 200,000 families have reunited through this program.

New Parent Insurance Requirements in 2025

The 2025 update to the Super Visa insurance policy introduces stricter and more transparent financial and coverage rules. The goal is to protect both visitors and the Canadian healthcare system.

Minimum Health Insurance Coverage:

As of 2025, Super Visa applicants must present proof of:

- Minimum coverage: CAD $100,000 or higher

- Duration: At least one year of continuous coverage

- Validity: Insurance must be purchased before entering Canada

- Coverage area: Must include all provinces and territories

- Providers: Must be from a Canadian insurance company approved by IRCC (Immigration, Refugees and Citizenship Canada)

What’s Covered:

- Emergency medical care

- Hospitalization and repatriation

- Ambulance and diagnostic services

- Prescription medications during emergencies

New Rule (2025): Some insurance policies must now clearly show direct payment arrangements with hospitals, not just reimbursement systems.

Cost of Canada Super Visa 2025 Insurance

The cost depends on factors such as age, health, and duration of stay. Here’s a quick overview:

| Age Group | Average Cost (CAD/year) | Coverage |

|---|

| 40–59 | $900–$1,500 | $100,000 |

| 60–69 | $1,200–$2,400 | $100,000 |

| 70–79 | $1,800–$3,800 | $100,000 |

| 80+ | $3,000+ | $100,000–$150,000 |

Pro Tip: Choosing $150,000 coverage can strengthen your visa approval chances and ensure better protection.

Eligibility Criteria for Canada Super Visa 2025

To qualify for the Canada Super Visa, applicants must meet specific conditions outlined by IRCC:

- Be the parent or grandparent of a Canadian citizen or permanent resident.

- Have a signed invitation letter from your child or grandchild living in Canada.

- Provide proof of minimum income (LICO) from the sponsor.

- Show valid Super Visa medical insurance coverage for at least one year.

- Pass a medical exam (if required).

LICO (Low Income Cut-Off): Sponsors must meet a specific income threshold to ensure they can financially support the visiting family member.

You can find the updated LICO table for 2025 on the official IRCC website.

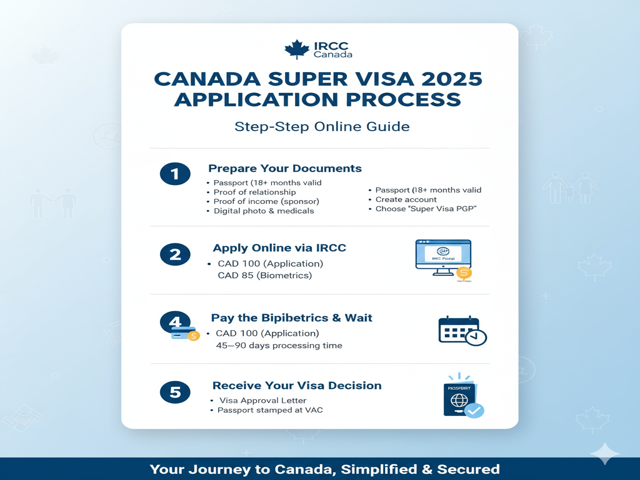

Step-by-Step Canada Super Visa 2025 Application Process

Applying for a Canada Super Visa in 2025 is now completely online. Here’s how it works:

1. Prepare Your Documents

- Passport (valid for at least 18 months)

- Invitation letter

- Proof of relationship

- Proof of income (sponsor)

- Super Visa insurance proof

- Digital photo and medical reports

2. Apply Online via IRCC

Visit the official IRCC portal and create an account. Choose “Super Visa for parents and grandparents.”

3. Pay the Application Fee

As of 2025, the application fee is CAD 100, and the biometric fee is CAD 85 (if applicable).

4. Submit Biometrics & Wait

You’ll receive a biometric instruction letter within a few days. After submission, average processing times range between 45–90 days depending on the country.

5. Receive Your Visa Decision

Once approved, you’ll receive a Visa Approval Letter. The visa itself will be stamped in your passport by the nearest Visa Application Centre (VAC).

Super Visa vs Regular Visitor Visa

| Feature | Super Visa | Visitor Visa |

|---|---|---|

| Duration per stay | Up to 5 years | 6 months |

| Validity | Up to 10 years | 10 years |

| Medical Insurance | Mandatory | Optional |

| Application Type | For parents/grandparents | For all visitors |

| Processing | Priority for family reunification | General processing |

Trusted Super Visa Insurance Providers (2025)

IRCC-approved providers include:

- Manulife Canada (manulife.ca)

- Allianz Global Assistance (allianzassistance.ca)

Many families use comparison sites like BestQuote Travel Insurance to compare coverage and pricing.

Tips for a Successful Canada Super Visa 2025 Application

- Always buy insurance before applying.

- Use direct payment insurance instead of reimbursement-based plans.

- Include a clear income statement from your sponsor.

- Apply 3–4 months in advance to avoid delays.

- Double-check if your country requires biometrics.

Impact of the Canada Super Visa 2025 Reforms

The 2025 reforms make the process more transparent and secure, but they also increase accountability. Applicants with incomplete insurance documentation are now more likely to be denied entry.

However, with these reforms, Canada continues to lead globally in family immigration policies, prioritizing long-term stays and emotional well-being for families separated by borders.

Read More: Canada Express Entry 2025: CRS Score Trends

FAQs: Canada Super Visa 2025

1. What’s new in the Canada Super Visa 2025?

The 2025 update introduces stricter health insurance requirements and encourages Canadian-based insurance purchases.

2. Can I buy insurance from outside Canada?

Only if it meets IRCC’s requirements, but Canadian-based providers are preferred.

3. How long can I stay in Canada with a Super Visa?

Up to 5 years per entry, extendable for another 2 years.

4. Can the Super Visa lead to permanent residency?

Not directly, but it strengthens your family immigration history for future sponsorship programs.

5. What happens if my insurance lapses?

You may lose your Super Visa status and face difficulties re-entering Canada.

Agent Advise: A Family-Friendly Future

The Canada Super Visa 2025 continues to empower family connections — now with stronger financial security through upgraded insurance standards. By preparing your documents early, purchasing compliant insurance, and following the latest IRCC updates, families can enjoy stress-free long-term visits in Canada.

Pingback: Canada Student Visa 2025: Powerful Work Hour Boost