Why Digital Nomads Are Flocking to Argentina in 2025

Argentina is quickly becoming South America’s digital nomad capital — and it’s easy to see why. With its low cost of living, strong Wi-Fi, world-class coffee culture, and visa-friendly government policies, the Argentina Digital Nomad Visa 2025 is opening doors for freelancers and remote workers worldwide.

But what’s even more exciting? The tax benefits.

If you’re a remote professional seeking sun-soaked workdays in Buenos Aires, affordable Malbec, and legal ways to optimize your global taxes, this guide covers everything you need to know about Argentina’s Digital Nomad Visa and its 2025 tax perks.

What Is the Argentina Digital Nomad Visa 2025?

The Argentina Digital Nomad Visa 2025 was designed to attract global freelancers, entrepreneurs, and remote workers. It allows you to live and work legally in Argentina while being employed by foreign clients or companies.

Key Highlights (2025 Update):

- Validity: Up to 1 year (renewable once).

- Eligibility: Must work remotely for non-Argentine companies.

- Application Fee: Around USD 200 (subject to consulate).

- Processing Time: 20–45 days.

- Work Permission: Online or remote work only — no local employment.

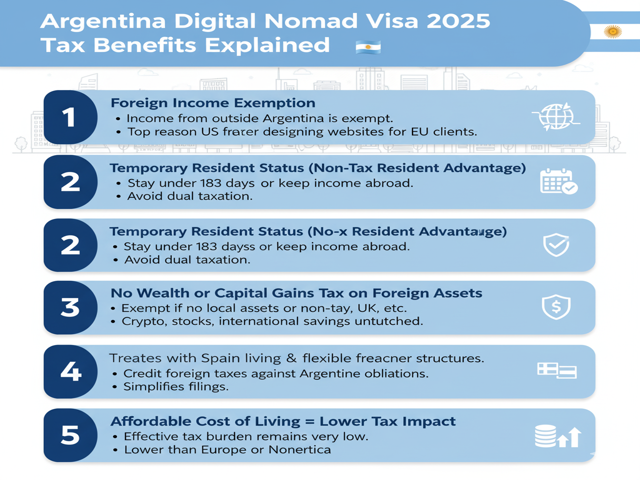

Argentina Digital Nomad Visa 2025 Tax Benefits Explained

1. Foreign Income Exemption

If your income comes from outside Argentina, you may be exempt from paying local income tax.

This is one of the top reasons remote workers are choosing Argentina in 2025.

Example:

If you’re a U.S. freelancer designing websites for clients in Europe, your income remains foreign-sourced — meaning Argentina won’t tax it as long as you don’t invoice Argentine clients.

2. Temporary Resident Status (Non-Tax Resident Advantage)

Digital nomads under this visa don’t automatically become tax residents.

To be considered a tax resident, you must stay:

- More than 183 days in Argentina within a 12-month period, or

- Have your main economic interests based there.

Tip: Stay under 183 days or keep your income abroad to avoid dual taxation.

3. No Wealth or Capital Gains Tax on Foreign Assets

Argentina’s standard tax system includes wealth taxes, but digital nomads are exempt if they don’t own local assets or aren’t tax residents.

That means your crypto, stocks, and international savings remain untouched.

4. Double Taxation Treaties

Argentina has tax treaties with several countries (like Spain, Italy, Germany, and the UK) to prevent you from paying taxes twice.

If you’re from one of these countries, you can credit your foreign taxes against Argentine obligations — simplifying your filings.

5. Affordable Cost of Living = Lower Tax Impact

Even if you end up paying some local taxes, Argentina’s cost of living and flexible freelancer structures mean your effective tax burden remains very low compared to Europe or North America.

Smart Tax Optimization Tips for Nomads in Argentina

Keep Your Income in Foreign Accounts

Use platforms like Wise or Revolut to receive international payments.

Avoid Local Client Contracts

Keep all invoices and income sources foreign to retain tax-exempt status.

Stay Below the 183-Day Threshold

Rotate between countries every few months to remain a non-resident.

Hire a Local Tax Consultant

They can help you navigate any tax changes under Argentina’s evolving digital economy.

Track Your Stays and Earnings

Use tools like Nomad List, Expensify, or Travel Mapper for automatic residency tracking.

Best Cities in Argentina Digital Nomad Visa 2025

- Buenos Aires – Cosmopolitan, café culture, and great co-working hubs.

- Mendoza – Wine region, peaceful mountain backdrop, and outdoor lifestyle.

- Cordoba – University vibe, tech scene, and affordable rent.

- Bariloche – Perfect for remote work with lake views and fresh air.

How to Apply for the Argentina Digital Nomad Visa 2025 (Step-by-Step)

- Prepare Documents:

- Valid passport

- Proof of remote employment/income

- Health insurance covering Argentina

- CV and motivation letter

- Background check

- Submit Application Online:

Via Argentina’s immigration portal or your nearest consulate. - Attend Interview (If Required):

Some applicants may be asked to verify details. - Wait for Approval:

Typically within 3–6 weeks. - Enter Argentina and Register Locally

Once approved, register with Dirección Nacional de Migraciones (DNM) to activate your visa.

Argentina vs Other Digital Nomad Tax Benefits (2025 Comparison)

| Country | Tax on Foreign Income | Cost of Living | Visa Duration | Remote-Friendly? |

|---|

| Argentina | ❌ No | 💲 Affordable | 1 Year (Renewable) | ✅ Excellent |

| Portugal | ✅ Partial | 💲💲 Moderate | 2 Years | ✅ Strong |

| Thailand | ✅ Limited | 💲 Low | 10 Years (Elite Visa) | ✅ Excellent |

| Spain | ✅ Partial | 💲💲 High | 1 Year (Renewable) | ✅ Excellent |

Argentina clearly stands out for low taxes and lifestyle value.

Source: Official Argentina Migration Portal

Pro Tip for Argentina Digital Nomad Visa 2025: Combine Argentina with “Tax-Friendly Nomad Hubs”

For true tax efficiency, many nomads pair Argentina with stays in:

- Paraguay (0% tax on foreign income)

- Uruguay (tax holidays up to 10 years)

- Panama (territorial taxation system)

This South American circuit gives you a year-round, visa-friendly, low-tax lifestyle.

Read Also: Mexico Digital Nomad Visa 2025 Application Process

FAQs: Argentina Digital Nomad Visa 2025 Tax Benefits

1. Do I need to pay taxes in Argentina as a digital nomad?

No, not if your income is earned abroad and you don’t exceed 183 days of residency.

2. Can I open a local bank account?

Yes, but it’s optional. Many nomads use Wise or Revolut for better rates.

3. What if I work with Argentine clients?

That income may be taxable — best to keep foreign contracts only.

4. Is cryptocurrency income taxed in Argentina?

Only if you’re a tax resident. Otherwise, it remains untaxed abroad.

5. Can I extend my visa after one year?

Yes, you can renew it once for another year (total 2 years max).

Agent Advise: Argentina Digital Nomad Visa 2025 Tax Heaven

Argentina Digital Nomad Visa 2025 isn’t just about tango, steak, and football — it’s a gateway to smart financial freedom.

With zero tax on foreign income, affordable living, and a thriving digital culture, it’s one of the best deals for remote workers this year.

If you’re looking to stretch your earnings while exploring a vibrant Latin lifestyle, Argentina should be your next base.

Pingback: Argentina Tourist Visa 2025 Exciting Reciprocity Fee Changes

Pingback: Argentina Retirement Visa 2025: Unlock Pension Benefits