Why Is a Landmark Year for Digital Nomad Visa Insurance 2026

Digital Nomad Visas have opened global frontiers for remote professionals — but 2026 brings a major shift. Governments worldwide are tightening insurance regulations for nomads to ensure health, safety, and financial protection while abroad.

If you’re a freelancer, remote employee, or content creator planning to live and work overseas, understanding Digital Nomad Visa Insurance 2026 is crucial. From Europe’s mandatory coverage rules to Asia’s digital compliance checks, this guide explains everything you need to know to stay compliant and protected.

Understanding Digital Nomad Visa Insurance 2026

Digital Nomad Visa Insurance 2026 refers to international travel and health insurance designed for long-term remote workers who live abroad under special visa programs.

In 2026, several countries have made insurance coverage mandatory to qualify for these visas. The aim is to ensure that digital nomads are financially secure in case of medical emergencies, natural disasters, or travel disruptions.

Key Coverage Areas Include:

- Emergency medical care (hospitalization, surgery, or outpatient)

- COVID-19 and pandemic-related costs

- Repatriation or evacuation

- Trip cancellations and delays

- Theft or damage to personal property

- Third-party liability coverage

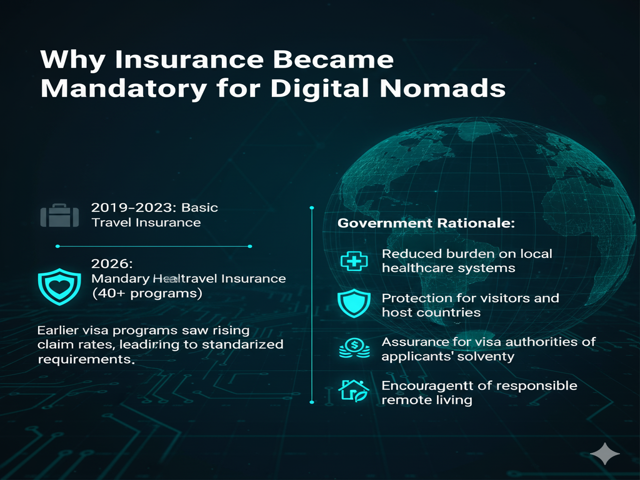

Why Insurance Became Mandatory for Digital Nomads

In earlier visa programs (2019–2023), many nations allowed freelancers and digital nomads to enter with basic travel insurance. But as claim rates rose during the pandemic, countries realized they needed standardized insurance requirements.

By 2026, over 40 digital nomad visa programs have included mandatory health or travel insurance clauses.

Government Rationale:

- Reduced burden on local healthcare systems

- Protection for visitors and host countries

- Assurance for visa authorities of applicants’ solvency

- Encouragement of responsible remote living

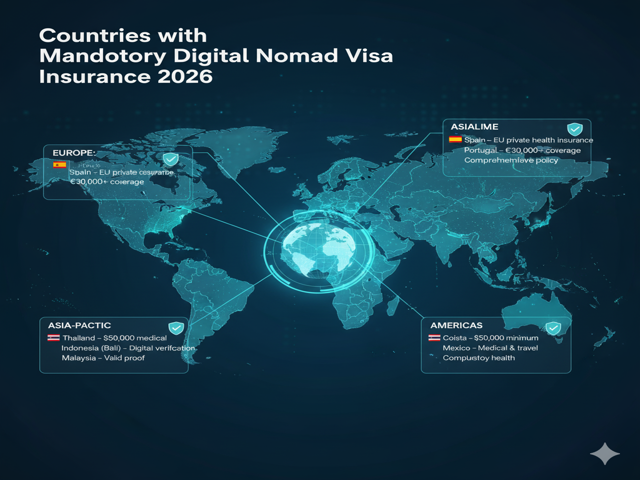

Countries with Mandatory Digital Nomad Visa Insurance 2026

Europe

- Spain – Requires proof of private health insurance valid throughout the EU.

- Portugal – Applicants must show international insurance with €30,000+ coverage.

- Croatia – Mandates comprehensive policy covering healthcare and evacuation.

- Greece – Compulsory medical insurance with validity for visa duration.

- Italy (new 2026 program) – Includes insurance verification at application stage.

Asia-Pacific

- Thailand – Insurance must cover up to $50,000 in medical costs.

- Indonesia (Bali) – Coverage is checked through the new digital verification portal.

- Malaysia – Visa will be invalidated without valid insurance proof.

- Australia – Working remotely? Nomads must show “adequate medical coverage.”

Americas

- Costa Rica – Insurance covering $50,000 minimum required for approval.

- Mexico – Encourages both medical and travel coverage for remote visa holders.

- Brazil – 2026 update includes compulsory health insurance for all remote workers.

Recommended Global Insurance Providers for Nomads

Here are trusted international providers offering digital nomad visa insurance 2026 packages:

SafetyWing Popular among nomads for flexibility and global coverage.

World Nomads Covers both medical and adventure-related claims.

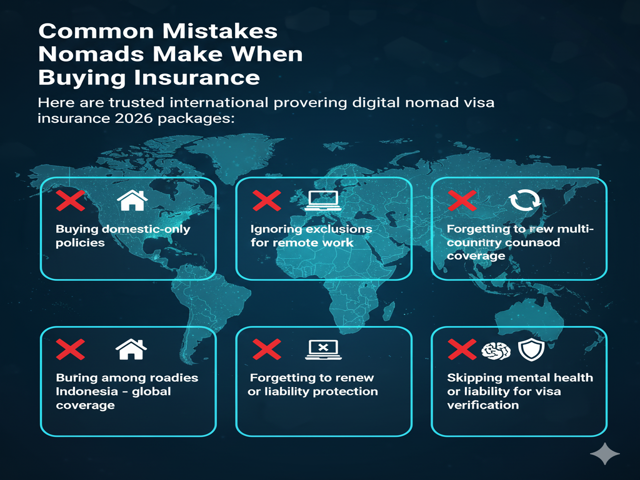

Common Mistakes Nomads Make When Buying Insurance

Many travelers overlook crucial details when applying for coverage. Avoid these pitfalls:

- ❌ Buying domestic-only policies

- ❌ Ignoring exclusions for remote work

- ❌ Forgetting to renew multi-country coverage

- ❌ Skipping mental health or liability protection

- ❌ Not keeping digital copies for visa verification

Tip: Always upload a PDF copy of your insurance policy during your visa application to avoid rejection or processing delays.

How AI and Digital Systems Verify Insurance in 2026

Visa systems now use AI verification portals to validate policy authenticity. For example:

- EU Digital Visa Portal cross-checks insurance details in seconds.

- Asian Nomad Visa hubs use blockchain-based policy verification.

- Latin America integrates insurer APIs for real-time validation.

This automation ensures no applicant submits forged or expired documents.

Average Insurance Costs for Digital Nomad Visa Insurance 2026

| Region | Average Monthly Premium | Typical Coverage |

|---|---|---|

| Europe | $45–$90 | Medical + Trip Protection |

| Asia | $35–$70 | Medical + Repatriation |

| Latin America | $30–$60 | Medical + Emergency Evacuation |

| Africa | $25–$55 | Medical + Liability |

| North America | $60–$110 | Full International Health |

Country-Specific Application Tips

- Portugal: Must include insurance provider’s tax ID in the application.

- Spain: Policies must specify worldwide validity.

- Costa Rica: Must show coverage letter from insurer.

- Thailand: Requires submission via their Digital Nomad Portal.

How to Choose the Right Digital Nomad Visa Insurance 2026 Plan

Consider these before buying:

- 🌍 Coverage across multiple countries

- 💵 Adequate policy value (minimum $50,000)

- 💊 Inclusion of medical evacuation

- 🕐 Renewal flexibility for long stays

- 🧳 Luggage and tech gear coverage

Global Trends: How Insurance Impacts Visa Success

In 2026, over 25% of visa rejections are due to insufficient or invalid insurance documentation. Governments now treat it as a core eligibility factor, not a mere recommendation.

By investing in a compliant plan, applicants significantly improve their chances of approval.

Step-by-Step Guide to Meeting Digital Nomad Visa Insurance 2026 Requirements

- Research destination’s visa rules

- Compare insurance plans (minimum coverage + validity)

- Purchase and download proof

- Upload policy in digital format (PDF or JPEG)

- Confirm acknowledgment from visa portal

- Save receipt for renewal or travel extensions

Why 2026 Is a Turning Point for Global Nomads

With international authorities unifying their remote work policies, insurance compliance has become a passport to global mobility.

Nomads without valid insurance may now face visa cancellation or border refusal, even if already approved.

Frequently Asked Questions

Q1: Is Digital Nomad Insurance mandatory for every visa?

Yes, over 40 countries require it as part of the application in 2026.

Q2: What minimum coverage should I get?

Most programs demand at least $30,000–$50,000 in medical coverage.

Q3: Can I use travel insurance instead of health insurance?

Some countries accept it if it includes full medical and evacuation coverage.

Q4: How long should the policy last?

It must match your visa duration — typically 6–12 months.

Q5: Can I change insurers mid-visa?

Yes, but you must report updates to your local immigration authority.

Explore more guides on our site: Remote Work Visa Tax Implications 2025: What You Must Know

Agent Advise: Protect Yourself, Empower Your Journey

The Digital Nomad Visa Insurance 2026 framework is a vital safeguard for the global remote workforce. Beyond mere compliance, it represents responsibility and foresight — qualities every modern nomad must embody.

Whether you’re working from a café in Lisbon or a villa in Bali, secure your insurance first — your freedom to roam depends on it.

Pingback: BRICS Visa-Free Movement 2026: Progress in Travel Freedom

Pingback: Mexico Digital Nomad Visa 2025: Powerful Application Guide